In the city of San Diego, where the real estate market is ever-evolving, securing a loan or mortgage is a significant financial move. One of the pivotal decisions you’ll encounter in this journey is the choice between a fixed or variable interest rate. This decision can influence your financial stability for years to come, so it’s essential to be well-informed.

This guide is tailored specifically for San Diego residents, aiming to shed light on the intricate world of interest rates. We’ll delve deep into the advantages, disadvantages, and the nuances that differentiate fixed and variable rates. Moreover, we’ll provide insights into current market trends and historical data, ensuring you have a holistic understanding of the subject.

What Are Interest Rates?

At its essence, an interest rate signifies the price you pay for the privilege of borrowing money. It’s typically denoted as an annual percentage rate (APR), which represents the yearly cost of the loan, including fees. Lenders, whether they’re banks, credit institutions, or private entities, charge interest as a means to not only cover their operational costs but also to earn a profit. This profit ensures they can continue to provide loans and contribute to the economy’s liquidity.

When it comes to the types of interest rates, there are primarily two categories that borrowers should be familiar with:

- Fixed Interest Rates: As the name suggests, fixed interest rates remain constant throughout the loan’s duration. This means that borrowers have the advantage of knowing exactly what their monthly payments will be, offering a sense of financial stability and predictability. Especially in volatile economic times, a fixed rate can be a haven for those who prioritize budgeting without surprises.

- Variable or Adjustable Interest Rates: These rates are dynamic, changing based on underlying benchmark interest rates or market conditions. Initially, variable rates might be set lower than fixed rates, making them seemingly attractive. However, they come with the inherent risk of fluctuating—either increasing or decreasing—as the market ebbs and flows. For risk-takers or those who closely monitor the financial markets, variable rates can offer opportunities for savings, but they also require a readiness for potential rate hikes.

Understanding interest rates and their types is crucial for anyone venturing into borrowing or lending. It’s a decision that requires careful consideration of one’s financial position, market knowledge, and risk appetite. Whether you’re leaning towards a fixed or variable rate, always ensure you’re making an informed choice, ideally with expert guidance.

The Basics of Fixed Interest Rates

In the realm of loans and mortgages, fixed interest rates stand out as a popular choice for many borrowers. But what exactly does it mean to have a fixed rate, and why might it be the right choice for you?

Defining Fixed Interest Rates

When you opt for a fixed rate loan, you’re essentially locking in a specific interest rate for the entirety of the loan’s term. Regardless of how long that term might be—whether it’s 10, 20, or 30 years—that rate won’t budge. Consequently, your monthly payment remains consistent throughout the loan’s duration.

Key Advantages of Fixed Rates:

- Predictability: One of the primary benefits of fixed rates is the certainty they bring. There are no surprises—you’ll always know the exact amount due each month, making financial planning a breeze.

- Stability Amidst Market Fluctuations: Economic landscapes can be volatile, with interest rates sometimes experiencing significant shifts. With a fixed rate, you’re insulated from these changes. Even if market rates skyrocket, your loan’s interest rate remains untouched.

- Simplified Budgeting: Consistency is a boon for budgeting. When you have a fixed rate, there’s no need to account for potential payment increases in your monthly or yearly budget. This can alleviate financial stress and make managing your finances more straightforward.

Is a Fixed Rate Right for You?

Fixed interest rates resonate with borrowers who value peace of mind above all else. If you’re someone who prefers stability over potential short-term savings and wants to avoid the unpredictability of market fluctuations, a fixed rate might be your ideal choice. It’s especially suitable for those who plan to stay in their home for a long time and want to ensure their monthly expenses remain consistent.

The Basics of Variable Interest Rates

In the vast spectrum of loans and financing options, variable interest rates present an intriguing choice for many borrowers. Unlike their fixed-rate counterparts, variable rates are dynamic, adjusting in response to market conditions. But what does this mean for you as a borrower, and when might a variable rate be the right choice?

Understanding Variable Interest Rates

Variable rate loans are directly influenced by an underlying benchmark, often the prime rate or another market index. As this benchmark shifts—either rising or falling—so too will the interest rate on your loan. Consequently, your monthly payments will vary, reflecting these rate adjustments.

Key Advantages of Variable Rates:

- Attractive Initial Rates: One of the standout features of variable rates is their often lower starting rate compared to fixed rates. This can mean lower initial monthly payments, potentially making it more affordable in the short term.

- Opportunities for Savings: The dynamic nature of variable rates means that if market rates decrease, so will your interest rate. This can lead to reduced monthly payments, offering potential savings over the loan’s duration.

- Enhanced Flexibility: When interest rates are low, borrowers have the opportunity to pay off their loan faster without incurring hefty interest charges. This can be especially beneficial for those looking to reduce their loan balance quickly.

Is a Variable Rate the Right Fit for You?

Variable interest rates cater to borrowers who have a higher risk tolerance and are comfortable navigating the ebb and flow of market conditions. If you’re financially stable, can accommodate potential payment increases, and are looking to capitalize on favorable market trends, a variable rate might align with your goals. However, it’s essential to be prepared for potential rate hikes and ensure you can manage higher payments should rates rise.

Fixed vs. Variable Rates in San Diego Now

In the ever-evolving financial landscape of San Diego, understanding the current state of interest rates is crucial for potential borrowers. As of August 2023, the city is witnessing a distinct trend in the mortgage rate environment.

Current Rates at a Glance:

- Fixed Mortgage Rates: Presently, fixed mortgage rates in San Diego hover between 7% and 8%. This rate is a reflection of the broader economic climate and the strategies employed by financial institutions to navigate it.

- Variable Mortgage Rates: In contrast, variable rates are currently positioned slightly lower, averaging in the mid-6% range. These rates, while attractive, come with the inherent unpredictability of potential future fluctuations.

The Broader Economic Context:

The Federal Reserve has taken a proactive stance this year, implementing aggressive rate hikes in a bid to combat rising inflation. This strategy is a clear indicator of the direction in which the financial winds are blowing. With more Fed rate hikes anticipated in the latter part of 2023, experts are forecasting a continued upward trajectory for interest rates.

What Does This Mean for San Diego Borrowers?

In the current financial climate, San Diego residents considering a mortgage should weigh their options with a forward-looking lens. While the allure of fixed rates might seem tempting given the anticipated short-term rate hikes, there’s a broader picture to consider.

Opting for an Adjustable Rate Mortgage (ARM) now could be a strategic move. Here’s why:

- Short-Term Rate Increases: Although we’re likely to see a slight uptick in rates over the next year, this increase is expected to be temporary.

- Anticipated Rate Drops: Based on market analyses and economic indicators, there’s a strong consensus that rates will experience a decline shortly after their brief ascent. This presents a potential window of opportunity for those with ARMs.

- Refinancing Potential: For those who choose an ARM now, there’s the added advantage of refinancing when rates dip. By doing so, borrowers can lock in a lower rate for the long term, translating to significant savings over the life of the loan.

In essence, while the immediate future suggests higher rates, the longer-term outlook is more favorable. For savvy borrowers, this could be an opportune moment to capitalize on the benefits of an ARM, with a view to refinance when the rates inevitably drop.

How to Choose Between Fixed and Variable

In the world of mortgages and loans, one of the most pivotal decisions borrowers face is the choice between fixed and variable interest rates. Both options come with their unique set of advantages and potential drawbacks. To make an informed decision, it’s essential to evaluate several key factors and align them with your financial goals and comfort level.

1. Assessing Your Budget:

The foremost consideration should be your financial capacity. While variable rates might offer lower initial payments, they come with the inherent risk of potential rate hikes. Ask yourself: If rates were to rise, would your budget comfortably accommodate higher monthly payments? It’s crucial to ensure that any potential increase won’t strain your finances.

2. Gauging Your Risk Tolerance:

Everyone’s comfort level with financial uncertainty varies. Some borrowers are willing to embrace the ebb and flow of market rates, banking on potential savings. Others might prioritize stability, preferring the predictability of fixed monthly payments. Reflect on your personal risk threshold and how you’d feel with fluctuating payments.

3. Considering the Loan Term:

The duration of your loan can influence which rate type is more advantageous. For instance, with longer terms like 30-year mortgages, the stability of a fixed rate can be especially beneficial, shielding you from decades of potential market volatility. However, if you’re leaning towards a shorter term, a variable rate might offer more immediate savings.

4. Factoring in Future Plans:

Your long-term intentions for the property and the loan play a role. If you anticipate moving within a few years or have plans to pay off your loan ahead of schedule, variable rates can offer greater flexibility. They often come with fewer penalties for early repayment, allowing you to capitalize on favorable market conditions.

5. Staying Informed on Market Forecasts:

While no one can predict the future with absolute certainty, expert analyses and market forecasts can provide valuable insights. Currently, there’s a strong sentiment that, despite potential short-term rate increases, a decline is anticipated in the not-so-distant future. This perspective suggests that opting for an Adjustable Rate Mortgage (ARM) now, with the strategy to refinance when rates dip, could be a financially savvy move.

The decision between fixed and variable rates is multifaceted and deeply personal. It requires a blend of introspection, financial planning, and market awareness. Given the current market predictions and the potential advantages of ARMs, borrowers might find themselves well-positioned to capitalize on the benefits of variable rates, especially with a proactive approach to future refinancing.

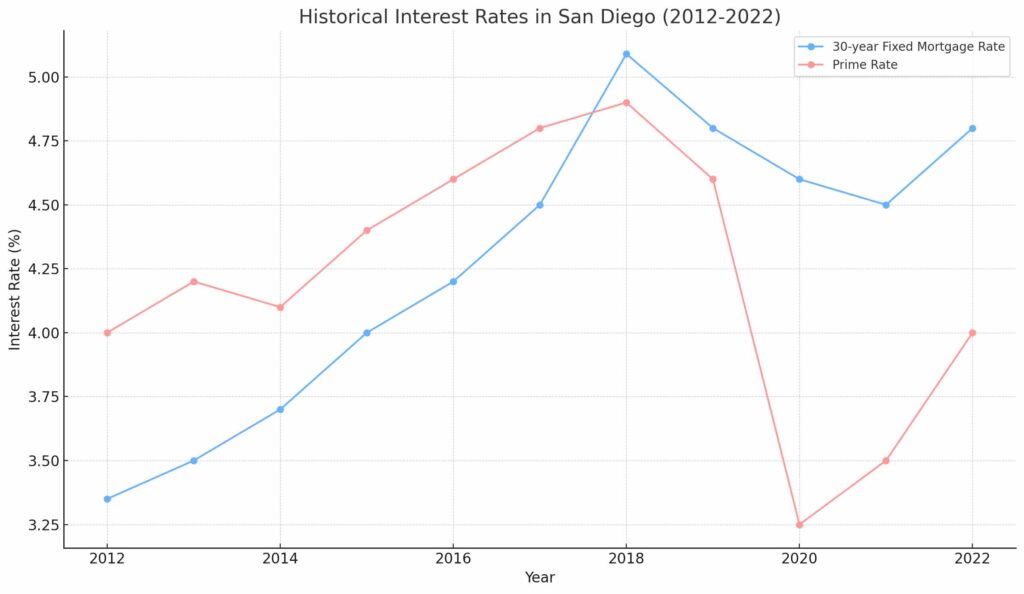

Historical Interest Rates in San Diego

To truly grasp the nuances of today’s rate landscape in San Diego, it’s beneficial to reflect on historical trends.

In the last decade, San Diego’s 30-year fixed mortgage rate has seen its ebbs and flows. It touched a favorable low of 2.5% in 2020, only to climb to a notable 8% by 2023. On the other hand, the prime rate, a key influencer for variable mortgages, mirrored a similar trajectory, bottoming at 3.25% in 2020 and peaking at 8.5% in 2023.

While the overarching trend since the early 1980s has been a decline from the staggering highs of over 10% APR for fixed rates, history reminds us of the market’s unpredictability. Economic dynamics can, and often do, usher in unexpected rate surges.

Decide What’s Best for Your Financial Situation

The journey of selecting between fixed and variable interest rates is more than just numbers; it’s about aligning with your financial aspirations, understanding market trends, and being prepared for future economic shifts. Your decision should resonate with your budgetary constraints, long-term plans, risk appetite, and the ever-evolving economic landscape of San Diego.

Every mortgage, loan, or line of credit comes with its set of implications. By meticulously weighing the pros and cons and staying informed about historical and current rate trends, you position yourself to secure the most favorable financing terms.

For San Diego residents seeking guidance in this intricate decision-making process, remember: you’re not alone. As a dedicated loan officer in this vibrant city, I stand ready to assist, answer queries, and help craft an interest rate strategy tailored to your unique financial blueprint and objectives.