With over 20 years of experience and hundreds of satisfied customers in San Diego, I understand firsthand how critical it is for prospective homeowners to thoroughly analyze historical mortgage rates before purchasing a home or refinancing their mortgage. Having an expert perspective on where rates have been and why can prove invaluable when making one of the biggest financial decisions of your life.

This post will explore historical mortgage rate trends specific to America’s Finest City from the post-World War II boom years of the 1950s through today’s rising rate environment. As a trusted mortgage loan officer in San Diego for over two decades, I have helped countless clients time their purchases and lock in favorable interest rates by understanding the lessons of the past.

By studying factors like inflation, Federal Reserve actions, and bond market movements that influence mortgage rates over decades-long cycles, you can gain key insights to help guide your decisions. This detailed historical perspective will provide San Diegans the knowledge needed to take advantage of dips in rates, weigh the trade-offs of different loan terms, and ultimately determine the smartest mortgage strategies for financing a home purchase or refinancing an existing loan.

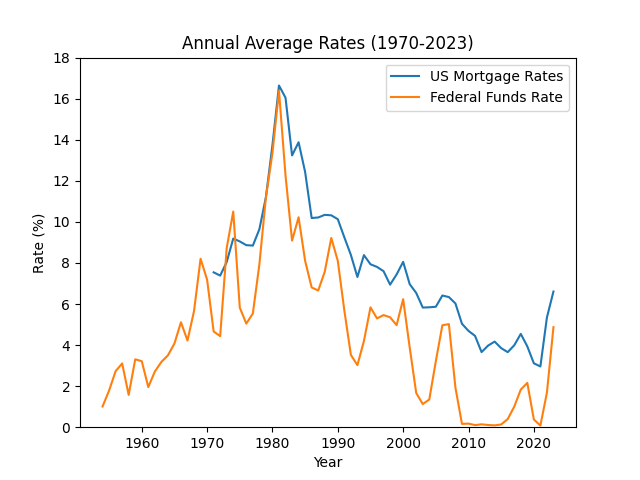

I will highlight era-defining trends in San Diego mortgage rates since the 1950s along with graphs for visual representation. You will also discover how rates have fluctuated over the last 10 years in particular, helping shed light on what may be in store for the future. My goal is to equip prospective San Diego homeowners with the historical context necessary to make wise financial choices in any rate environment.

Why Historical Mortgage Rates Matter

When preparing to finance the biggest purchase of your life—your home—having a deep understanding of historical mortgage rate trends is absolutely essential. Arming yourself with decades of historical context will provide the knowledge you need to make astute financial decisions.

Mortgage rates can fluctuate dramatically over relatively short time frames. But zooming out and analyzing rates over long periods—as far back as the 1950s—illuminates key patterns. Surges and declines in rates are often driven by major economic cycles tied to inflation, monetary policy, employment, and growth.

By understanding what triggered past mortgage rate movements and cycles, you gain powerful insight into where rates are headed in the future. Savvy homebuyers use rate history to help time their purchase to capitalize on dips and avoid peaks. The expected trajectory of rates also determines whether adjustable rate or fixed rate mortgages make more sense.

Beyond purchase timing and loan types, historical rates help you select appropriate repayment terms. The spread between 15-year and 30-year fixed rates has averaged 0.5% over the decades, but has fluctuated between 0.25% to 1%. Knowing historical norms allows you to weigh the trade-offs and determine if a shorter term is worthwhile.

In addition, analyzing periods of past rate volatility provides context on the benefits of locking in rates when they are low versus floating in anticipation of declines. Having perspective across decades of data informs your ability to weigh risks appropriately.

In summary, historical mortgage rates shed light on the cyclical nature of the real estate financing market. They provide the context needed to filter out short-term rate swings and focus on major trends. As an experienced mortgage advisor in San Diego for over 20 years, I highly recommend arming yourself with this knowledge before making major financial decisions. Please read on for an in-depth exploration of historical rate trends.

Historical Mortgage Rates Since 1950

Mortgage rates have fluctuated substantially over the past 70+ years. In the 1950s and early 1960s, rates for a 30-year fixed mortgage sat in the 5% range. But they began climbing through the late 60s, exceeding 10% in the 1970s as inflation surged.

Rates peaked at over 18% in the early 80s before falling for most of the next four decades. The 30-year fixed rate dipped below 4% in the early 2010s for the first time ever. After rising off those lows for a few years, the COVID-19 pandemic triggered another steep drop starting in 2020.

Mortgage Rates in the 1960s

As America’s postwar economy boomed in the early 1960s, mortgage rates fell to some of their lowest levels in modern history. In the mid-1960s, the average 30-year fixed rate mortgage fell below 6% for the first time ever. Rates for a conventional 30-year mortgage dipped to 5.83% by 1964.

Unfortunately, inflation started rising later in the decade, pushing rates back up over 7% by 1969. But the 60s represented a golden age for mortgage borrowers that hasn’t been replicated since on a sustained basis.

Interest Rates Over the Last 10 Years

Focusing just on the last decade, mortgage rates have cycled through dramatic highs and lows. In 2012 and 2013, rates on 30-year fixed loans were consistently above 3.5%. But improving economic conditions kept pushing them down, ultimately bottoming out at 3-3.25% in late-2012.

As the economy strengthened coming out of the Great Recession, rates began rising steadily from 2016 to 2018. The 30-year fixed rate hit 4.75% in late 2018—the highest in 7 years. But the surge in rates caused homebuying and refinancing activity to slow, allowing rates to start falling through 2019.

The COVID-19 recession triggered unprecedented intervention by the Federal Reserve to lower rates. In early-2021, 30-year fixed rates dipped below 3% for the first time in recorded history. But inflation has caused rates to rise sharply through 2022 back up to near 5%.

Mortgage Rates Over Time

Beyond just analyzing select data points, visually charting mortgage rate movements over long periods clearly illustrates the trends. The below graphs depict the history of 30-year fixed rates compared to 10-year Treasury yields and the Fed Funds rate.

Rates trends closely follow the direction of the 10-year Treasury, which acts as a baseline for mortgage rates. Meanwhile, actions by the Federal Reserve also strongly influence rates since they dictate the nation’s monetary policy.

The Lowest 30-Year Mortgage Rates Ever

Determining the lowest 30-year fixed mortgage rates ever recorded provides helpful historical perspective on where rates could potentially go in the future. According to Freddie Mac data going back to 1971, the all-time lowest 30-year fixed rate recorded was 2.65% in January 2021.

Rates for conventional 30-year mortgages had never before dipped below 3% until the COVID-19 recession. The first time average 30-year rates briefly fell below 3% was for a few weeks in late-2012 during the Great Recession. Prior to 2020, the lowest rates tended to bottom out around 3.3-3.6% during periodic rate cycle lows.

Economists view the 3-4% range as an historically low level for 30-year fixed mortgage rates. Interest rates are primarily determined by the yields on 10-year US Treasury bonds. And yields had never been sustainably below 3% for any significant length of time prior to the COVID downturn.

The unprecedented intervention in 2020-2021 by the Federal Reserve to stabilize financial markets after COVID pushed Treasury yields to record lows below 1%. This allowed 30-year fixed mortgage rates to dip below 3% for the first time ever and then plunge to under 2.7% at their lowest point.

However, these ultra-low rates were an anomalous driven by a black swan event. As the Fed reverses course and raises interest rates to fight inflation, expectations are that 30-year fixed mortgage rates will not return to the 2.65-3% range again anytime soon.

While rates can fluctuate widely over months and even years, history shows they have never sustainably remained below 3% long-term in normal economic environments. But paying close attention to Fed policy provides clues on when dips to historically low levels may occur again.

Current 30-Year Mortgage Rates News

In 2023, rapidly rising inflation has pushed mortgage rates dramatically higher at the fastest pace on record. As of mid-September, average rates on a 30-year fixed mortgage have spiked above 7%—the highest levels since 2008.

This surge in rates has occurred as the Federal Reserve aggressively raises its benchmark interest rate to combat inflation not seen in 40 years. After keeping rates near zero since the pandemic onset, the Fed has raised its federal funds rate from 0.25% to over 3% in just the past seven months.

These sharp Fed rate hikes have caused yields on 10-year Treasury notes to nearly double over that time frame. Since Treasury yields underpin mortgage rates, this has translated to over 2 percentage points of increases in average 30-year fixed mortgage rates since January.

Economists predict that 30-year fixed rates may increase a bit more before potentially dropping, assuming the higher rates successfully curb economic growth and ease inflation. However, these forecasts are subject to change based on new data.

This current rising rate cycle underscores the importance of closely following news reports on inflation and Federal Reserve monetary policy. Paying attention to Fed statements and economic data releases can provide valuable signals on when mortgage rates may peak and resume a downward trajectory.

Being able to time a home purchase or refinance to capitalize on eventual rate declines requires diligently monitoring market news. As an experienced mortgage professional, I always keep abreast of current events impacting rate movements so I can best advise my clients. Please reach out so I can help you make informed decisions during this volatile time for mortgage rates.

Conclusion

I hope this overview of historical mortgage rates provides useful guidance as you navigate the home financing process. Leverage the lessons of the past to make smart decisions and secure favorable interest rates for your San Diego home purchase or refinance. I’m always available to consult directly if you need personalized mortgage advice. Let’s connect to determine the ideal loan programs and lock in the perfect rate for your needs!