In the intricate world of home financing, especially in a vibrant market like San Diego, there are many terms and concepts that buyers and refinancers will come across. One such term that often raises eyebrows and prompts questions is the “escrow account.” For those new to the home buying process or even seasoned homeowners looking to refinance, the idea of an escrow account can seem like yet another layer of complexity in an already intricate journey.

However, escrow accounts play a pivotal role in the home financing landscape. They serve as a protective mechanism, ensuring that crucial expenses related to the property are paid on time. But what exactly is an escrow account? How does it function, and what are its advantages and potential drawbacks?

In this article, we aim to shed light on the mysteries surrounding escrow accounts. We’ll delve into their core purpose, the benefits they offer to both lenders and borrowers, and any potential challenges you might face. By the end, you’ll have a comprehensive understanding of escrow accounts, empowering you to navigate your San Diego mortgage with confidence and clarity.

What is an Escrow Account?

Imagine an escrow account as a dedicated savings pot, held by your mortgage lender, specifically designed to cover certain recurring expenses related to your home. Instead of you having to remember when to pay your property taxes or home insurance premiums, the lender handles these payments for you.

Here’s how it works:

- Monthly Contributions: Every month, when you make your mortgage payment, a specific portion of that payment is set aside into the escrow account. This portion is over and above your principal and interest payment and is meant to accumulate over time.

- Scheduled Payments: When it’s time to pay significant expenses like property taxes or home insurance premiums, the lender uses the funds accumulated in the escrow account to make these payments on your behalf. This ensures that these crucial bills are paid on time, every time.

- Protection for Both Parties: The primary reason lenders use escrow accounts is to protect their investment in your property. By ensuring that taxes and insurance are always paid on time, they prevent tax liens or lapses in insurance coverage that could jeopardize the property’s value or their stake in it.

In essence, an escrow account simplifies the homeownership process. It provides peace of mind, knowing that essential expenses are managed and paid punctually, safeguarding both the homeowner and the lender.

The Role of Escrow in Home Loans

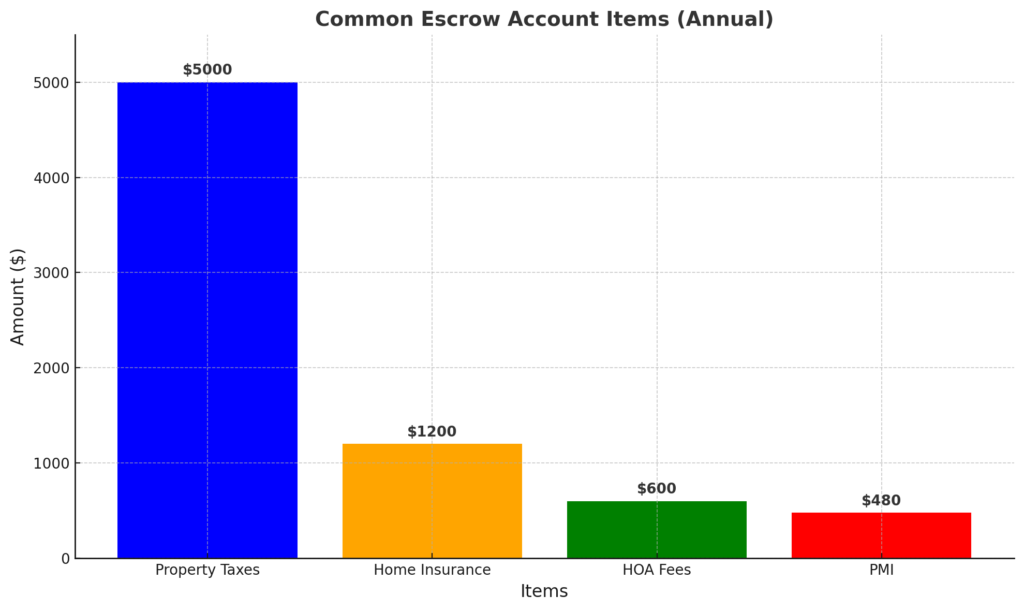

For mortgages, escrow accounts typically cover:

By collecting funds upfront, escrow ensures these critical payments are made on time to mitigate risk. Most lenders require escrow accounts for conventional loans.

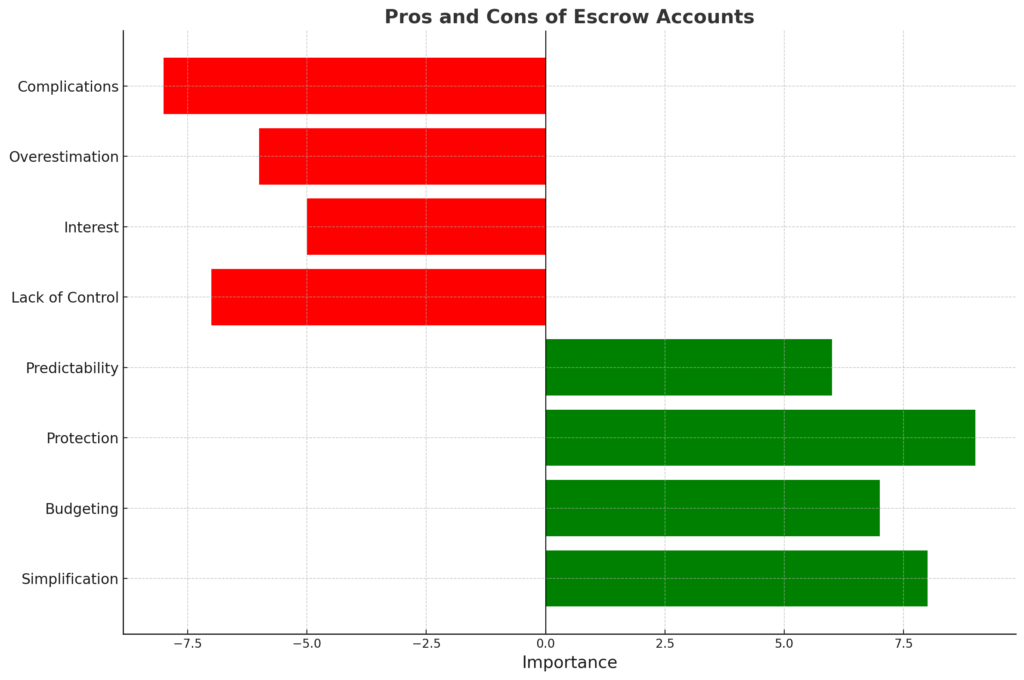

Benefits of Having an Escrow Account

- Simplification: One of the primary advantages of an escrow account is the convenience it offers. Instead of juggling multiple bills and due dates, homeowners can consolidate their property tax, homeowner’s insurance, and sometimes even homeowner’s association fees into a single monthly payment. This streamlining reduces the hassle of managing multiple payments and ensures that everything is paid on time.

- Budgeting: Large, lump-sum payments can strain a homeowner’s finances. Escrow accounts help by breaking down these substantial annual or semi-annual expenses into manageable monthly chunks. This spreading out of costs aids homeowners in planning their finances better and avoiding the shock of a big bill.

- Protection: Missing a property tax payment or letting insurance lapse can have serious consequences, from tax liens to a lack of coverage in the event of damage. With an escrow account, these crucial payments are made punctually on the homeowner’s behalf, ensuring continuous coverage and compliance with tax obligations.

- Predictability: Knowing the total monthly outlay helps homeowners anticipate and prepare for their financial obligations. With an escrow account, there’s clarity on the total monthly mortgage-related expenses, making it easier to budget and plan other financial activities.

Drawbacks of Escrow Accounts

- Lack of Control: While escrow accounts offer convenience, they also mean homeowners relinquish direct control over when and how specific bills are paid. For those who prefer to manage their finances closely, this can feel restrictive.

- Interest: The funds held in an escrow account typically don’t earn interest. If homeowners were to manage these funds themselves in an interest-bearing account, they might earn a small return over time.

- Overestimation: Lenders often estimate the amount needed for the escrow account, and sometimes they might overestimate. This can lead to slightly higher monthly payments than necessary. However, adjustments are usually made annually to correct any overages.

- Complications: While rare, mistakes can happen. There might be errors in calculations, missed payments, or misestimations. These errors can lead to complications, such as underfunding or overfunding the account, requiring homeowners to stay vigilant and communicate with their lender to rectify any issues.

While escrow simplifies payments, it does deprive homeowners of some control over their funds and budgets.

Understanding Escrow Account Rules

When it comes to managing escrow accounts, lenders adhere to a set of specific and stringent guidelines to ensure both the protection of their investment and the convenience of the homeowner. Here’s a deeper dive into these rules:

- Monthly Payment Calculation: The amount you contribute to the escrow account each month isn’t arbitrary. Lenders meticulously calculate this based on the estimated annual costs of property taxes and homeowner’s insurance. By dividing these annual figures by 12, they determine the monthly escrow contribution, ensuring there’s enough in the account to cover these expenses when they come due.

- Annual Analysis: Financial situations, property tax rates, and insurance premiums can change. Recognizing this, lenders conduct an annual review of the escrow account. This analysis checks if the monthly contributions align with the actual expenses. If taxes or insurance costs have risen or fallen, the monthly escrow payment might be adjusted accordingly for the upcoming year.

- Handling Surpluses: Sometimes, the escrow account might accumulate more funds than necessary, leading to a surplus. Regulations stipulate that any surplus over a specific limit (often set by federal or state guidelines) must be refunded to the borrower. This ensures that homeowners aren’t overpaying into the account and that any excess funds are promptly returned.

By familiarizing themselves with these rules, homeowners can better understand the workings of their escrow account, ensuring transparency and trust in the mortgage process.

Managing Your Escrow Account

While escrow accounts are primarily managed by lenders, homeowners aren’t entirely without influence. There are avenues available for those looking to optimize their escrow arrangements:

- Adjusting Monthly Payments: If you believe that your property taxes have decreased or if you’ve secured a more affordable insurance premium, you can present this evidence to your lender. By doing so, there’s potential to adjust and lower your monthly escrow contributions, reflecting the updated costs.

- Considering Escrow Cancellation: In certain circumstances, homeowners might prefer to manage property-related expenses independently. While not common, it’s possible to cancel an escrow account. However, this requires explicit approval from the lender, and there might be specific criteria to meet before considering this option.

For personalized advice and insights on managing your escrow account, I’m here to assist you. With expertise in the intricacies of the mortgage landscape, I can provide guidance tailored to your unique circumstances. Navigating the world of home financing can be complex, but with the right advice, you can make informed decisions that align with your financial aspirations. Don’t hesitate to reach out and discuss any questions or concerns you may have.

Special Cases: VA Loans and No Escrow Mortgages

While many loan types adhere to standard escrow practices, there are specific cases that come with their own set of rules. Let’s delve deeper into these special cases to ensure clarity:

- VA Loans and Escrow Accounts: VA loans, designed specifically for veterans and active-duty military members, have a unique feature when it comes to escrow accounts. During the appraisal process of a property under a VA loan, if certain repairs are deemed necessary for the home to meet VA standards, an escrow account can be set up specifically to cover these repair costs. This ensures that the property is up to par and that veterans are moving into homes that meet a certain standard of quality and safety.

- No Escrow Mortgages: While the majority of mortgages come with escrow accounts to streamline the payment of property-related expenses, there are exceptions. Some lenders offer what’s known as “no escrow” mortgages. In these cases, homeowners are responsible for paying property taxes and insurance premiums directly, without the intermediary of an escrow account. This option might appeal to those who prefer to have more direct control over their payments, but it also requires diligence to ensure timely payment of all obligations.

For those navigating the intricacies of these special mortgage cases, having a knowledgeable guide can make all the difference. I’m here to provide expertise and clarity across all loan types and escrow account scenarios. Whether you’re considering a VA loan, curious about no escrow mortgages, or have questions about standard escrow practices, I’m committed to helping you understand every facet of the process.

Conclusion

Escrow accounts, though essential in safeguarding both lenders and homeowners, can often seem like a maze to many San Diego homebuyers. However, with the right guidance, this crucial component of the mortgage process can be seamlessly integrated into your home financing strategy. I’m here to offer that guidance. By partnering with me from the outset, you’ll gain a clear understanding and the insights necessary to make the most of your escrow account. My approach is not just transactional; it’s consultative. I’m dedicated to ensuring that every aspect of your mortgage, including the escrow, is tailored to fit your unique financial landscape and aspirations.