In the picturesque landscape of San Diego, where the real estate market is as dynamic as its beaches and city life, securing a mortgage for a home purchase or refinance is a significant step. Integral to this process is the professional appraisal, a pivotal component designed to establish the property’s current fair market value. While many prospective homeowners eagerly anticipate this phase, there’s often a cloud of mystery surrounding it. Many are left wondering: What exactly is an appraisal? Why is it so vital? And how does it impact my home buying journey?

What is a Home Appraisal?

At its core, a home appraisal is an independent inspection and valuation conducted by a licensed professional appraiser. But it’s more than just a cursory glance at your property.

Diving deep into the intricacies of your home, the appraiser meticulously surveys every nook and cranny. They evaluate its overall condition, any recent upgrades, the value of similar properties (known as comparable sales), and a myriad of other factors. This comprehensive assessment culminates in a fair market value estimate. Such a thorough evaluation serves a dual purpose: it ensures that homeowners get a fair deal without overpaying, and it safeguards lenders from potential financial risks associated with overvalued properties.

Why are Home Appraisals Crucial in the Loan Process?

The home buying journey is filled with numerous steps, each essential in its own right. Among these, the appraisal stands out as a pivotal phase, deeply intertwined with the loan process. Its importance can’t be overstated for several reasons:

- Lender Security: At the heart of the appraisal process is the lender’s need for security. By ensuring that the loan amount is in alignment with the property’s actual value, lenders can confidently extend credit. This accurate valuation acts as a safeguard, minimizing their exposure to potential losses should a borrower default on the loan. In essence, it’s a protective measure that maintains the financial integrity of the lending institution.

- Homebuyer Assurance: On the other side of the coin, appraisals are a protective measure for potential homeowners. By establishing a property’s true market value, appraisals ensure that buyers don’t end up paying more than what the property is genuinely worth. The appraised value acts as a benchmark, setting a justifiable upper limit for the loan amount. This not only provides peace of mind to the buyer but also fosters trust in the overall home buying process.

In sum, appraisals are a balancing act, harmonizing the interests of both lenders and homebuyers. They play a crucial role in ensuring that the loan process is both transparent and fair for all parties involved.

Factors that Influence a Home Appraisal

Professional appraisers consider multiple elements that impact a property’s value:

- Location – Where the home is situated can significantly influence appraisal. Prime locations in desirable school districts tend to appraise higher.

- Condition – The structural and mechanical condition of the home matters. Deferred maintenance, outdated systems, and damage can reduce appraised value.

- Upgrades – Remodels, finished basements, pools, and other upgrades boost appraisal when done properly. Outdated finishes can hurt value.

- Comparable sales – Appraisers research similar homes recently sold in the area. Higher sales prices on comparable properties support a higher valuation.

- Market conditions – Strength or weakness in the overall housing market flows through to individual appraisals. Appreciating markets lift values.

- Interest rates – Rising mortgage rates reduce buyers’ purchasing power which can negatively impact appraisals.

Understanding these influential factors can help homeowners better anticipate their home’s potential appraisal value ahead of time. Preparing appropriately sets up a smooth appraisal process.

The Appraisal Checklist: What Appraisers Look For

When appraising a home, professionals meticulously evaluate both the interior and exterior to assess condition and features. Key areas they focus on include:

- Curb appeal – First impressions of the home’s exterior, landscaping, and street presence.

- Roof and siding – Visually inspecting for damage, wear and tear, and remaining useful life.

- Floor plan – Room sizes, layout, functionality, and flow.

- Kitchen – Cabinetry, appliances, counters, sinks, and overall quality.

- Bathrooms – Fixtures, ventilation, storage, and cosmetic condition.

- Bedrooms – Dimensions, closets, windows, and finishes.

- Basement/attic – Headroom, insulation, ventilation, and utility.

- Mechanicals – Water heater, HVAC, electrical, and plumbing systems.

Knowing the areas of focus allows homeowners to make small repairs, clear clutter, stage rooms, and highlight features that support their home’s value. Proper preparation ensures the appraiser conducts an accurate assessment.

The Importance of Appraisals to Lenders

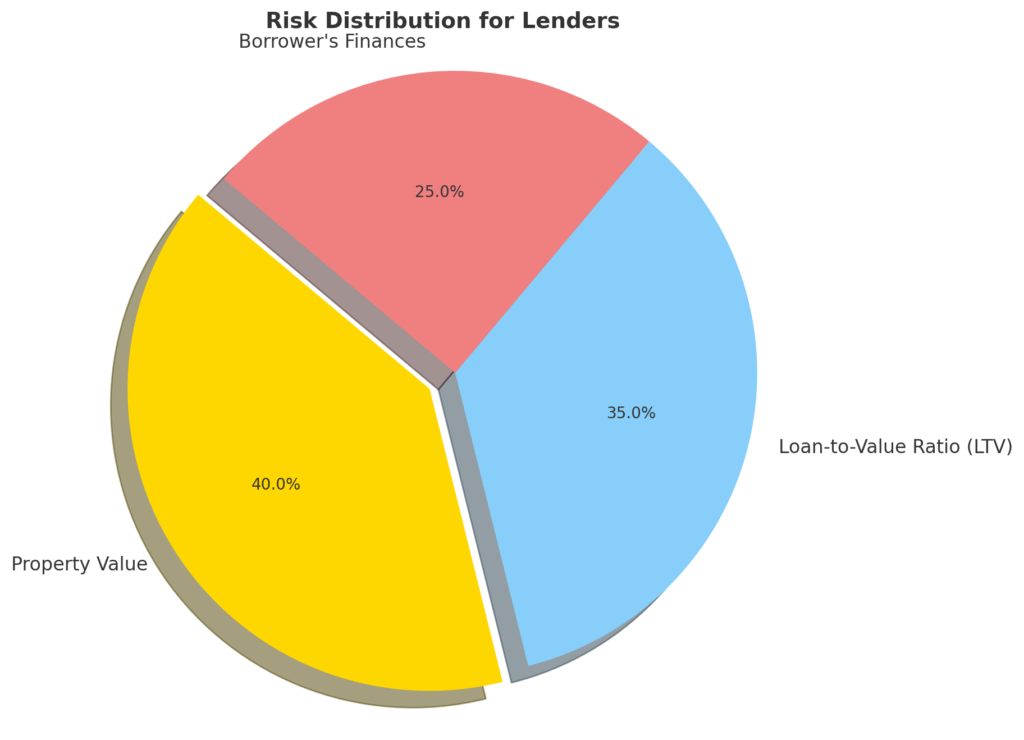

For lenders, the appraisal helps quantify risk across three key areas:

- Property Value: The estimated value of the property which sets loan limits and collateral value.

- Loan-to-Value Ratio (LTV): The ratio of the loan amount to the appraised value of the property. A higher LTV often indicates higher risk for the lender.

- Borrower’s Finances: This takes into account the borrower’s financial stability, creditworthiness, and ability to repay the loan.

The property value estimate sets loan limits and collateral value. Appraisals are a critical step in lenders’ due diligence.

Navigating a Lower-than-Expected Appraisal

Sometimes an appraisal comes back at a value lower than the agreed-upon purchase price or estimated value. This creates a gap that must be addressed. As a buyer, you have several options if you receive a low appraisal:

- Negotiate with the seller – Ask the seller to lower the purchase price to match the appraised value. This may require compromise on both sides.

- Contest the appraisal – Your lender can order a second appraisal or ask for a reconsideration of value if errors are found. However, appraisal challenges are rarely successful.

- Bring extra funds to close – You may pay the difference in cash if you still wish to purchase at the higher price. This avoids changing loan terms.

- Request seller contributions – The seller can opt to lower the price or contribute a credit at closing to help bridge the gap.

- Adjust down payment amount – Putting down a larger down payment lowers the loan amount to align with the appraisal.

- Change loan programs – Your lender may offer more flexible loan products like adjustable-rate mortgages to accommodate the gap.

My knowledgeable team can provide guidance on which path forward makes the most sense based on your specific situation and financial goals.

To maximize your home’s valuation, experts recommend several preparation tips before the appraiser visits:

- Declutter – Remove excess furniture and personal items so rooms appear spacious. Store any clutter out of sight.

- Clean thoroughly – Clean all surfaces, floors, windows, appliances so the home shines. Fix any damages like scuffs on walls.

- Improve curb appeal – Tend to the lawn, gardens, walkways, front door area so the exterior looks welcoming.

- Make small repairs – Fix any broken or damaged items like leaky faucets, holes in screens, squeaky hinges.

- Stage key rooms – Remove personal photos and decor from main rooms. Style furnishings attractively.

- Let in natural light – Open blinds, curtains, and shades so interior spaces appear bright and airy.

- Hide valuables – Secure jewelry, cash, and other enticing items out of sight.

Taking these steps ensures your home puts its best foot forward for the appraiser. A pristine, decluttered home allows the valuation to focus on the property’s strongest features. Proper staging highlights your home’s value.

Costs and Logistics of Home Appraisals

In San Diego, homeowners can expect to pay $300-$500 for a standard single-family appraisal. Condos may cost less. Lenders usually arrange and pay for purchase appraisals, while homeowners handle refinance appraisals.

I can explain estimated fees and scheduling for your specific scenario.

Conclusion

The appraisal process, while often overlooked, stands as one of the most critical phases in obtaining mortgage financing, especially in a dynamic real estate market like San Diego’s. It serves as a bridge between a buyer’s aspirations and the realities of the property market, ensuring that both parties in a transaction are protected and informed.

For San Diego residents, having a clear grasp of the appraisal’s role and significance can make a world of difference. It not only demystifies a complex procedure but also empowers homeowners to approach the process with confidence and clarity. A well-understood appraisal can be the difference between a smooth transaction and unexpected challenges.

However, like all processes, appraisals can sometimes yield unexpected results. If you find yourself in a situation where the appraisal value comes back lower than anticipated, it’s essential to know that there are avenues and resources available to guide you through the subsequent steps. Seeking advice and assistance early in the process can be invaluable, ensuring that each phase, including the appraisal, progresses without a hitch.

In the end, the journey to homeownership is filled with numerous steps, each with its own set of challenges and rewards. By understanding and valuing each phase, especially the appraisal, you set yourself up for a more informed and positive home buying experience.