Introduction

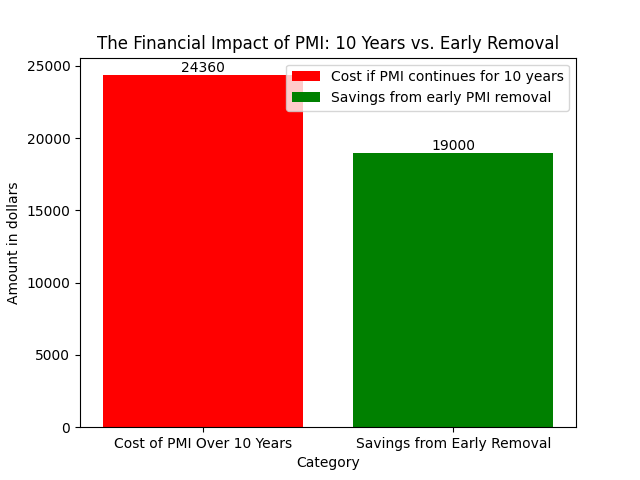

You’ve signed the papers, moved into your new home, and are faithfully paying off your mortgage. Everything seems perfect. After all, you’ve got a great interest rate of 3.3%, so what could possibly go wrong? As it turns out, overlooking small details like PMI (Private Mortgage Insurance) can cost you a substantial amount in the long run. In this article, we’ll discuss a real-life example of how a two-year post-closing mortgage checkup saved a client $19,000, and how it could potentially do the same for you.

Why You Shouldn’t Overlook a Mortgage Checkup

Many homeowners make the mistake of becoming complacent after securing a mortgage with a low interest rate. While a competitive interest rate is undoubtedly important, it’s just one piece of the puzzle when it comes to the overall cost of your mortgage. Here are several compelling reasons why you should never overlook the importance of a regular mortgage checkup.

The Illusion of a Low Interest Rate

Some clients hesitate when it comes to scheduling a mortgage checkup because they think they have a competitive interest rate. It’s easy to fall into the trap of believing that a low interest rate means you’re getting the best deal possible. However, this is far from the truth. A low interest rate doesn’t necessarily shield you from other costs that can sneak up on you, such as PMI.

The Hidden Costs: PMI and More

Private Mortgage Insurance (PMI) is a prime example of a hidden cost that can significantly inflate your monthly payments. PMI is often required if your down payment is less than 20%, and it can add hundreds of dollars to your monthly mortgage payment. Most people don’t realize they’re paying for PMI, or they forget to check when they can stop paying for it.

The Risk of Adjustable Rates

If you have an adjustable-rate mortgage (ARM), a mortgage checkup becomes even more crucial. ARMs come with interest rates that can fluctuate, meaning your low initial rate might not stay low forever. A mortgage checkup can help you assess whether it’s time to refinance into a fixed-rate mortgage to avoid future rate hikes.

Escrow Account Analysis

Another aspect often overlooked is the escrow account, which covers property taxes and homeowner’s insurance. An annual review can ensure that you’re not paying more than necessary and that your account is adequately funded.

Long-Term Financial Health

A mortgage is a long-term commitment that impacts your financial health for years to come. Regular checkups can help you identify opportunities for additional payments to reduce the loan term, thereby saving you money in interest over the life of the loan.

While a low interest rate is a good start, it’s not the be-all and end-all. A mortgage checkup allows you to take a holistic view of your mortgage, helping you uncover hidden costs and opportunities for savings. So, don’t let a seemingly low interest rate lull you into a false sense of security. Make mortgage checkups a regular part of your financial routine.

What Is PMI and Why Should You Care?

Private Mortgage Insurance, commonly known as PMI, is an insurance policy that borrowers are often required to purchase as a condition of receiving a mortgage loan. The primary purpose of PMI is to protect the lender in the event that the borrower defaults on the loan. While PMI serves this important function from the lender’s perspective, it can be a significant financial burden for homeowners.

When you’re in the process of buying a home, especially if it’s your first time, PMI might seem like just another item on a long list of expenses. However, it’s crucial to understand that PMI can add a considerable amount to your monthly mortgage payment. Depending on the size of your loan and your PMI rate, this could mean an additional cost ranging from a few dozen to several hundred dollars per month. Over the years, this can accumulate into a substantial sum, making your “affordable” home much more expensive in the long run.

Another important aspect to consider is that PMI is not a one-time expense but a recurring one, often lasting until you’ve built up sufficient equity in your home. The common threshold for stopping PMI payments is when you’ve reached 20% equity, although this can vary depending on your lender and the specific terms of your mortgage. This is why it’s essential to regularly check your mortgage statements and keep track of your home equity.

Some homeowners mistakenly believe that PMI will be automatically canceled once they reach the 20% equity mark. While some loan agreements do have clauses that require the lender to automatically terminate PMI under certain conditions, this is not always guaranteed. You may need to request the cancellation of PMI yourself, and in some cases, you might even need to undergo a new home appraisal to prove your home’s current value and corresponding equity.

While PMI serves to protect the lender, it’s an additional cost that homeowners should actively manage. By understanding what PMI is, keeping an eye on your mortgage statements, and being proactive about its cancellation, you can save a significant amount of money over the life of your mortgage.

Banks and PMI: The 10-Year Rule

In many mortgage agreements, banks include a provision that allows for the automatic removal of PMI after a certain period, often around the 10-year mark. While this automatic removal is beneficial for those who may not be aware of PMI or forget to cancel it, it’s not necessarily the most cost-effective approach for homeowners. Waiting for the bank to automatically remove PMI means you could be paying unnecessary premiums for years, even if you’ve already reached the equity threshold where PMI is no longer required.

The 10-year rule can lull homeowners into a false sense of security, leading them to believe that they don’t have to take action. However, in many cases, homeowners can reach the 20% equity threshold much sooner than 10 years, especially if the property’s value has increased or if they’ve made additional payments towards the principal. If you find yourself in this situation, you have the opportunity to act proactively and request the removal of PMI from your mortgage.

To do this, you’ll generally need to contact your lender and request a formal evaluation of your current loan-to-value ratio. Some lenders may require a new appraisal of your property to confirm its current market value, which can incur an additional cost. However, the cost of an appraisal is often a fraction of what you could save by eliminating PMI payments ahead of schedule.

By understanding the terms of your mortgage agreement and keeping a close eye on your equity status, you can take control of your financial future. Don’t simply wait for the bank to remove PMI based on a 10-year rule or other automatic provision. Instead, be proactive in managing your mortgage costs, and you could save thousands of dollars over the life of your loan.

Act Early and Reap the Rewards

One of our clients serves as a perfect example of the financial benefits that can be gained by acting early and being proactive about mortgage management. Just two years into their mortgage, we conducted a checkup and discovered that they had already reached 20% home equity. This was a significant milestone, achieved eight years ahead of the bank’s original projection.

The client’s rapid accumulation of equity was due to a combination of factors, including a rising housing market that increased their home’s value, as well as extra payments they had made towards the principal. Realizing the opportunity at hand, we advised them to contact their lender immediately to request the removal of PMI from their mortgage terms.

After reaching out to their lender and going through the necessary procedures, which sometimes can include a new home appraisal, they were successful in having the PMI removed. This resulted in immediate monthly savings of $203. When you extrapolate that over the eight years they would have otherwise been paying PMI, the total savings amount to an astounding $19,000.

This case study underscores the importance of regular mortgage checkups and proactive financial management. By keeping an eye on their home equity and understanding the terms of their mortgage, our client was able to seize an opportunity for significant long-term savings. It’s a compelling example of how taking early action can lead to substantial financial benefits, reinforcing the value of being attentive and proactive in managing your mortgage.

Conclusion

A mortgage is more than just a monthly payment; it’s a long-term financial commitment that can either be a burden or an opportunity for growth, depending on how you manage it. As we’ve shown through real-life examples, a simple mortgage checkup can be a game-changer. From uncovering hidden costs like PMI to identifying opportunities for early removal and substantial savings, a proactive approach can save you thousands of dollars over the life of your loan.

Don’t let the comfort of a low interest rate lull you into complacency. Your financial well-being deserves more than a set-it-and-forget-it attitude. The urgency to act is real, and the potential savings are too significant to ignore.

So, what are you waiting for? Schedule your mortgage checkup today and take the first step towards optimizing your mortgage and securing your financial future. The clock is ticking, and every month that passes could be another month of missed savings. Seize the moment and act now—your future self will thank you.