Embarking on the journey to homeownership is both exciting and, at times, overwhelming. One of the initial steps, and often a source of confusion, is understanding the distinction between mortgage pre-approval and pre-qualification. For San Diego residents with aspirations of settling into their dream homes, grasping this difference can be pivotal.

I’m here to provide clarity on this topic, ensuring you’re well-equipped to make informed decisions at every stage of your home buying process. In this article, we’ll delve into the nuances of pre-approval and pre-qualification, highlight their unique benefits, and offer guidance on which to pursue based on your individual circumstances.

Defining the Terms

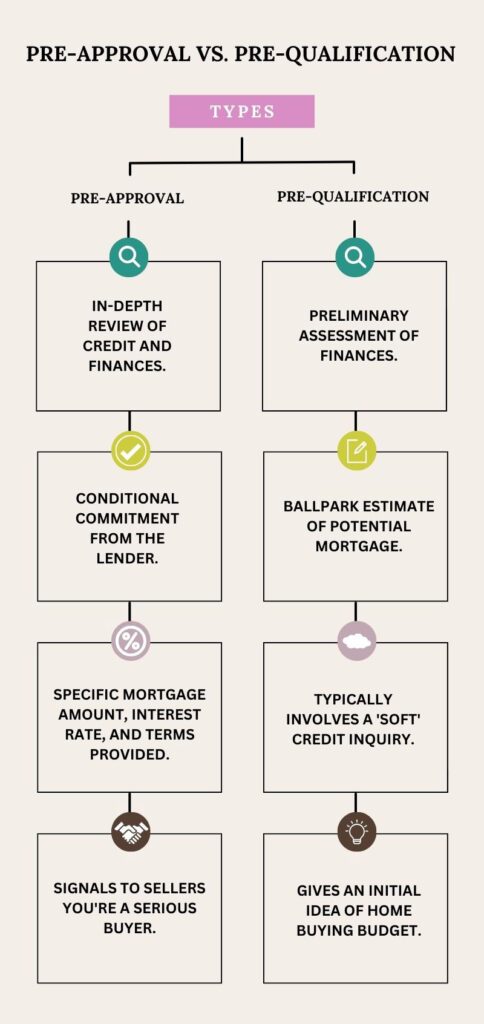

- Pre-approval: This is a more in-depth process where the lender conducts a comprehensive review of your credit history and financial background. After evaluating your financial health, the lender provides a concrete offer, specifying the mortgage amount, potential interest rate, and terms you qualify for. It’s akin to a conditional commitment, signaling to sellers that you’re a serious buyer.

- Pre-qualification: Think of this as a preliminary assessment. The lender offers a ballpark estimate of the mortgage amount you might qualify for based on a brief overview of your financial standing. This process typically involves a “soft” credit inquiry and doesn’t delve into detailed documentation. It’s a starting point, giving you an idea of your home buying budget.

While both terms revolve around mortgage eligibility, their depth and implications vary significantly. Understanding these nuances can position you advantageously as you navigate the San Diego real estate market.

Key Differences Between Pre-approval and Pre-qualification

Understanding the distinction between pre-approval and pre-qualification is essential for prospective homebuyers. These two terms, while closely related, serve different purposes in the home buying journey and offer varying levels of assurance to both buyers and sellers.

| Feature/Aspect | Pre-approval | Pre-qualification |

|---|---|---|

| Depth of Financial Review | Comprehensive review of credit history, income, assets, and liabilities. | Basic overview based on self-reported financial information. |

| Commitment Level | Conditional commitment indicating a specific loan amount and terms. | Preliminary estimate without any binding commitment. |

| Credit Check | Typically involves a “hard” credit inquiry, which might affect credit score. | Usually a “soft” credit inquiry, which doesn’t impact the credit score. |

| Documentation Required | Detailed documentation, including pay stubs, tax returns, and bank statements. | Minimal or no documentation; often based on verbal or written information. |

| Validity | Limited time validity, often 60-90 days, based on market conditions. | Varies by lender; generally a shorter validity than pre-approval. |

| Perception in Market | Viewed as a serious intent to buy; strengthens offers in competitive markets. | Useful for initial home shopping; might not hold as much weight with sellers. |

Pre-approval is akin to a deep dive into your financial standing, providing a clearer picture of your borrowing capacity. It’s a more definitive assessment, backed by a thorough review of all your financial details, from credit history to current liabilities. Sellers often view pre-approved buyers as more serious contenders, making it a valuable asset in competitive housing markets.

On the other hand, pre-qualification is like dipping your toes in the water. It provides a ballpark estimate of your potential loan amount, based on a lighter review of your finances. While it’s a useful starting point, especially for those in the early stages of home shopping, it doesn’t carry the same weight as pre-approval in the eyes of sellers.

Navigating the nuances of these processes can be intricate, but with the right guidance, you can determine which step to pursue first based on your unique situation and housing goals.

Benefits of Pre-approval

Pre-approval offers home buyers several advantages:

- Stronger position – Sellers know you can get financing to close the deal.

- Loan clarity – You know the exact mortgage amount, rate, fees, and terms you qualify for.

- Faster processing – Much of the documentation is complete, so final approval goes quicker.

Benefits of Pre-qualification

Alternatively, pre-qualification offers these perks:

- Quick assessment – Estimate your affordability with minimal paperwork.

- No credit impact – Soft credit check doesn’t affect your scores.

- Budget guidance – Helps narrow your home search to a realistic price range.

Which to Pursue First?

Embarking on the home buying journey often begins with understanding your financial standing and how much house you can afford. Both pre-approval and pre-qualification offer insights into this, but they serve different purposes and are suited for different stages of the home buying process. Here’s a detailed guide to help you decide which to pursue first:

- Early Stages & Casual Browsing:

- Recommendation: Pre-qualification

- Reasoning: If you’re in the very early stages of considering homeownership or casually browsing the market without a firm intent to buy immediately, pre-qualification can be a good starting point. It gives you a general idea of your borrowing capacity without the need for detailed documentation or a hard credit check. This way, you can set realistic expectations and narrow down your home search based on your estimated budget.

- Serious Home Shopping & Making Offers:

- Recommendation: Pre-approval

- Reasoning: When you’re actively searching for a home and are ready to make offers, pre-approval is the way to go. Sellers often view pre-approved buyers as more serious and committed. In competitive markets, having a pre-approval can give you an edge over other buyers. It signals to sellers that you’ve undergone a thorough financial review and are less likely to face hiccups in securing financing.

- Consider Your Credit:

- Recommendation: Weigh the impact of credit inquiries.

- Reasoning: Pre-approval typically involves a hard credit inquiry, which can have a minor impact on your credit score. If you’re concerned about your credit score or are working on improving it, you might want to time your pre-approval strategically. On the other hand, pre-qualification often involves a soft inquiry, which doesn’t affect your score.

- Market Dynamics:

- Recommendation: Adapt based on the housing market.

- Reasoning: In a highly competitive housing market, where homes receive multiple offers and sell quickly, having a pre-approval can make your offer stand out. Conversely, in a slower market, you might have more flexibility and time to start with pre-qualification and then move to pre-approval as you get closer to making an offer.

The choice between pre-approval and pre-qualification largely depends on your current stage in the home buying process, your financial readiness, and the dynamics of the housing market. Regardless of which you choose to pursue first, both processes provide valuable insights and pave the way for a smoother home buying experience.

Understanding Pre-approval and Pre-qualification Letters

When you undergo either the pre-approval or pre-qualification process, the lender provides you with an official letter that encapsulates your financial standing. These letters serve as:

- Proof of Preliminary Assessment: They validate that a lender has reviewed certain aspects of your financial situation.

- Communication Tools: Real estate agents and sellers view these letters as indicators of your seriousness and financial capability. They often use them to gauge the likelihood of a successful transaction.

Common Misconceptions

While these letters are valuable, it’s essential to understand their scope and limitations. Here are some clarifications to ensure you’re interpreting them correctly:

- Pre-approval Isn’t a Promise: While a pre-approval letter indicates a lender’s willingness to offer you a loan based on your current financial situation, it’s not an absolute guarantee. Before finalizing the loan, lenders will conduct a more thorough review, especially as you approach closing. Changes in your financial situation or property appraisals can influence the final decision.

- Pre-qualification Isn’t a Deep Dive: A pre-qualification letter provides an estimate of how much you might be able to borrow. However, it’s based on a preliminary review, often without a full credit check. It’s an initial gauge of affordability, not a definitive statement of loan eligibility.

- Room for Flexibility: Just because you have a pre-approval letter for a specific amount doesn’t restrict you to viewing homes only within that price range. Real estate agents can show you properties slightly above the pre-approved amount, giving you a broader perspective and more options.

Conclusion

The journey to homeownership in San Diego is filled with decisions, and one of the first and most crucial is understanding the distinction between mortgage pre-approval and pre-qualification. While both serve as indicators of your financial readiness, they differ in depth, commitment, and purpose.

Pre-approval delves deeper, offering a more definitive picture of your borrowing capacity based on comprehensive documentation. It’s a testament to your financial reliability and can be a significant asset when making offers in a competitive market. On the other hand, pre-qualification acts as a preliminary compass, guiding your initial steps in the vast landscape of home buying by providing a snapshot of potential loan amounts.

Embarking on this journey with the right guidance can make all the difference. By partnering with knowledgeable experts, you can demystify the complexities of the mortgage process and confidently stride towards your dream home. I’m here to offer that guidance, ensuring every step you take is informed and strategic. Reach out, and let’s chart the path to your future home together.